The Malaysian Sales Tax Act 2018 and Service Tax 2018 collectively Acts came into operation on 1 September 2018. Sales and service tax is operated under the Sales Tax Act 2018 and the Service Tax Act 2018.

Malaysia Sst Sales And Service Tax A Complete Guide

LVG that are sold online and those goods are imported into Malaysia.

. 1000144593 COURSE MODULES Taxation in Malaysia GST era SST 20 Sales Tax Service Tax Price Control and Anti Profiteering Act. Proposed legislationknown as The Sales Tax Amendment Bill 2022 and Service Tax Amendment Bill 2022was tabled on 1 August 2022 for first reading in the Parliament. One of the proposed measures in the bill concerns the sales.

Malaysias new Sales and Service Tax or SST officially came into effect on 1 September replacing the former Goods and Services Tax GST system and requiring Malaysian businesses to adjust to a new regime. In general a services provider providing a taxable service under the Service Tax Act 2018 must register when the value of taxable. SST is a tax on the consumption of goods and services consumed within Malaysia.

SCOPE CHARGE Sales tax is not charged on. Both manufacturers and service providers are liable to sign up for this service tax under the 2018 Act in Malaysia. It consists of two parts.

6 rate has been enacted for Sales and service tax SST by. The Sales Tax Amendment Bill 2022 to amend the Sales Tax Act 2018 Act 806 involves amending four existing sections and inserting five sections one schedule and one new section into the act. The amendment to Section 106 2 means that sellers would come under the ministers jurisdiction to make regulations over registration.

Previously the Act imposed sales tax on goods manufactured in Malaysia or imported into the country. Mohd Shahar said this has caused unfair treatment to local traders because imported goods are not taxed while locally produced goods are subject to sales tax at a set rate. In Malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the Sales Tax Act 2018.

The Service Tax Amendment Bill 2022 is to amend the Service Tax Act. The sales tax and service tax are intended to replace the goods and services tax. The Service Tax Amendment Bill 2022 is to amend the Service Tax Act 2018 Act 807 which among other things aims to facilitate the industry and taxpayers by extending.

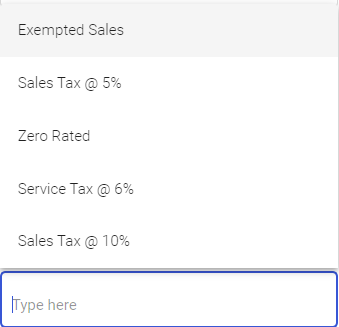

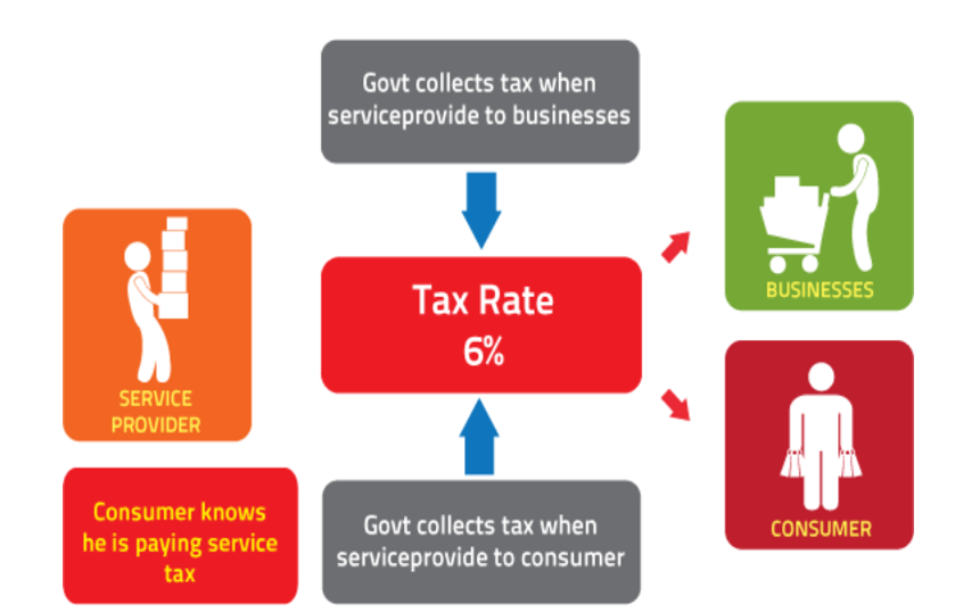

Proposed measures for sales tax on low-value goods include new requirements for online sellers. The service tax will stand at 6 and it would be levied. A 10 tax charged on all taxable goods manufactured in and imported into Malaysia.

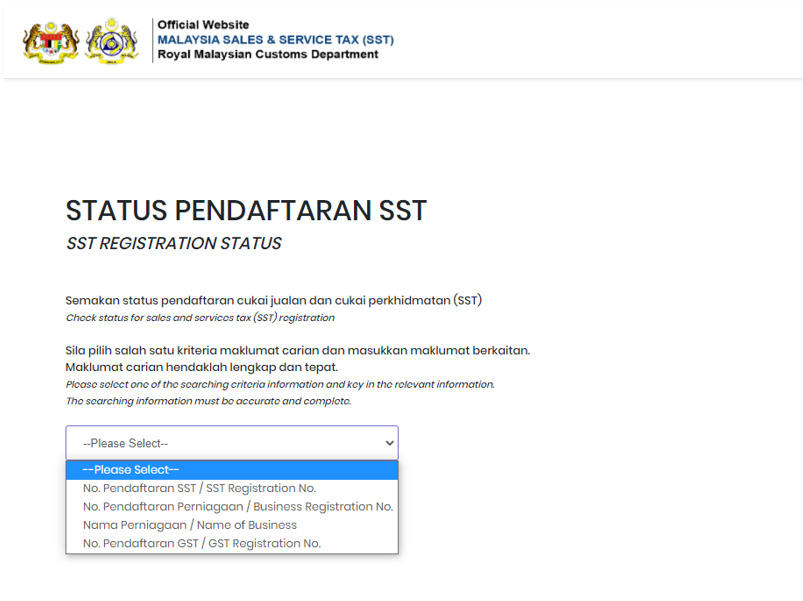

Persons exempted under Sales Tax Persons Exempted. Following the announcement of the re-introduction of SST the Royal Malaysian Customs Department RMCD has recently announced the implementation framework of SST as well as a detailed FAQs to arm Malaysians with sufficient knowledge before SST commence. The government collects Sales Tax at the manufacturers level only and the element of sales tax embedded in the price paid by the.

The Sales Tax and Service Tax were governed the Sales Tax Act 2018 and the Service Tax Act 2018. Sec 81 Sales Tax Act 2018 A tax to be known as sales tax shall be charged and levied on all taxable goods a manufactured in Malaysia by a registered manufacturer and sold used or disposed of by him. A 6 tax charged on any taxable services provided in Malaysia by a registered business.

In this regard the Goods and Services Tax Act 2014 has been repealed with effect from 1 September 2018. A product can only be taxed. The Sales Tax a single stage tax was levied at the import or manufacturing levels.

The Sales Tax was a federal consumption tax that was imposed on a wide variety of goods whereas the Service Tax was levied on customers who consumed some taxable services. In general a services provider providing a taxable service under the Service Tax Act 2018 must register when the value of taxable. Or b imported into Malaysia by any person.

Following are the facts you should know about Sales and service tax Malaysia. That meant only manufacturers and importers were under the jurisdiction of the finance minister. Malaysia Service Tax 2018.

Malaysias new Sales and Service Tax or SST officially came into effect on 1 September replacing the former Goods and Services Tax GST system and requiring Malaysian businesses to adjust to a new regime.

About Sales And Service Tax Sst In Malaysia Help Center Wix Com

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

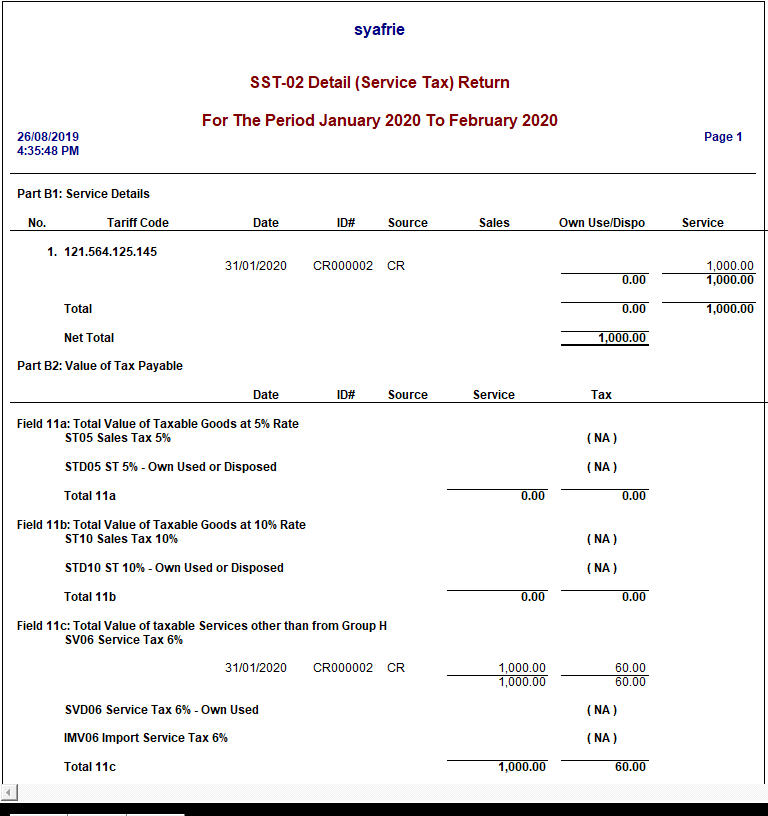

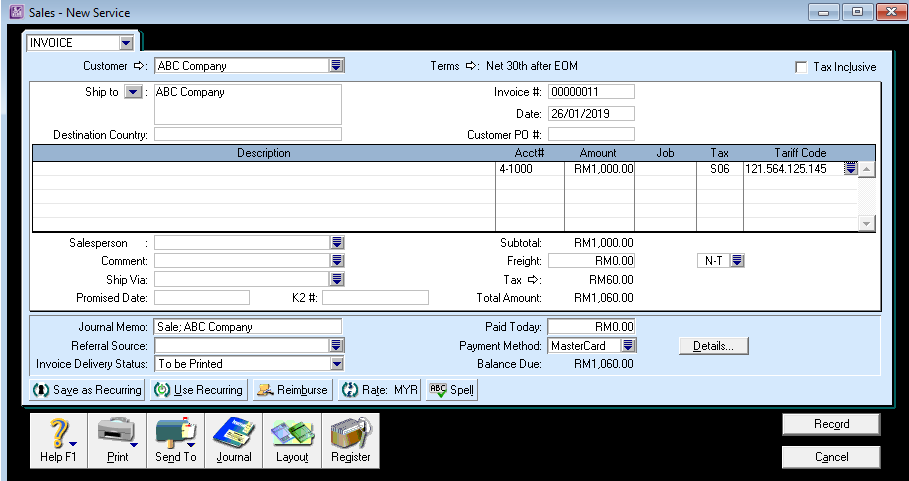

Service Tax 12 Month Deemed Paid Rule Abss Support

Malaysia Sst Sales And Service Tax A Complete Guide

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Malaysia Sst Sales And Service Tax A Complete Guide

Service Tax 12 Month Deemed Paid Rule Abss Support

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0